G'day and welcome to Overnight Success. A warm welcome to the 40 new subscribers that have joined since the last edition! You've just joined 1,008 other legends learning about Aussie start-ups.

1000 Subscriber Celebration

Over the week Overnight Success hit the milestone of 1,000 total active subscribers. To celebrate, we're doing a few exciting things.

New Branding & Logo. We've graduated from Canva exports to a funky and sleek new look courtesy of Skale Studio.

Website soft launch. Introducing overnightsuccess.vc the new home of Australian start-up news. We aim to help share some of the fantastic things happening in the Australian start-up ecosystem. Make sure you add overnightsuccess.vc to your bookmarks!

Melbourne Meet-up! Last week we asked you how you wanted to celebrate 1000 subscribers, and the overwhelming response was to head to a pub. So let's have a party! Register your interest here if you're in around and want to meet some fellow subscribers!

Headlines:

🚀 Techstars is coming Down Under!

One of the world’s largest pre-seed investors has announced it will run its flagship accelerator program in Tech Central Sydney, following confirmation of support from the NSW State Government until 2025. (Innovation Aus)

💔 Cut Through Venture calls an end to their monthly newsletter … but announces a new platform for Aussie start-up and VC data. (Smart Company)

The new platform is set to launch in February and will no doubt be much anticipated by the ~20,000 newsletter subscribers and many others, after making such a positive contribution to the ecosystem since launching in May 2021.

🙈 The redundancies continue across tech-land. While largely affecting the US tech workforce, local impacts of the economic slowdown are also emerging. This week’s big announcements:

Redbubble (Melbourne HQ) - cutting 14% of workforce, equivalent to 50 people. (AFR)

Microsoft - cutting nearly 5% of workforce, equivalent to 10,000 people. (TechCrunch)

Alphabet (Google’s parent company) - cutting 6% of workforce, equivalent to 12,000 people. (Bloomberg)

👀 ‘Tis the season to make some predictions. Here’s what people ‘in the know’ are saying about the Aussie VC landscape for 2023:

Where VCs will put their cash in 2023: And it’s not in crypto or groceries (The Australian)

Aussie VCs ready for the next tech boom: Generative AI (AFR)

‘Orange is the new Palo Alto’: Why the next Atlassian, Canva will be from the bush (SMH)

What are investment deals looking like in today’s climate? Startup advisers and investment managers weigh in (Smart Company)

Start-up Retro: Australia's start-up raises with a smidge of context.

Notice Board: Signposting key events and opportunities.

Accredited Tweeters: Snippets from mostly Aussie start-up Twitter.

(KaaS) Knowledge as a Service: Articles to make you smarter. Or to share with co-workers to make them think you’re smart.

⚡️Start-up Retro⚡️

Mining & Construction / Safety

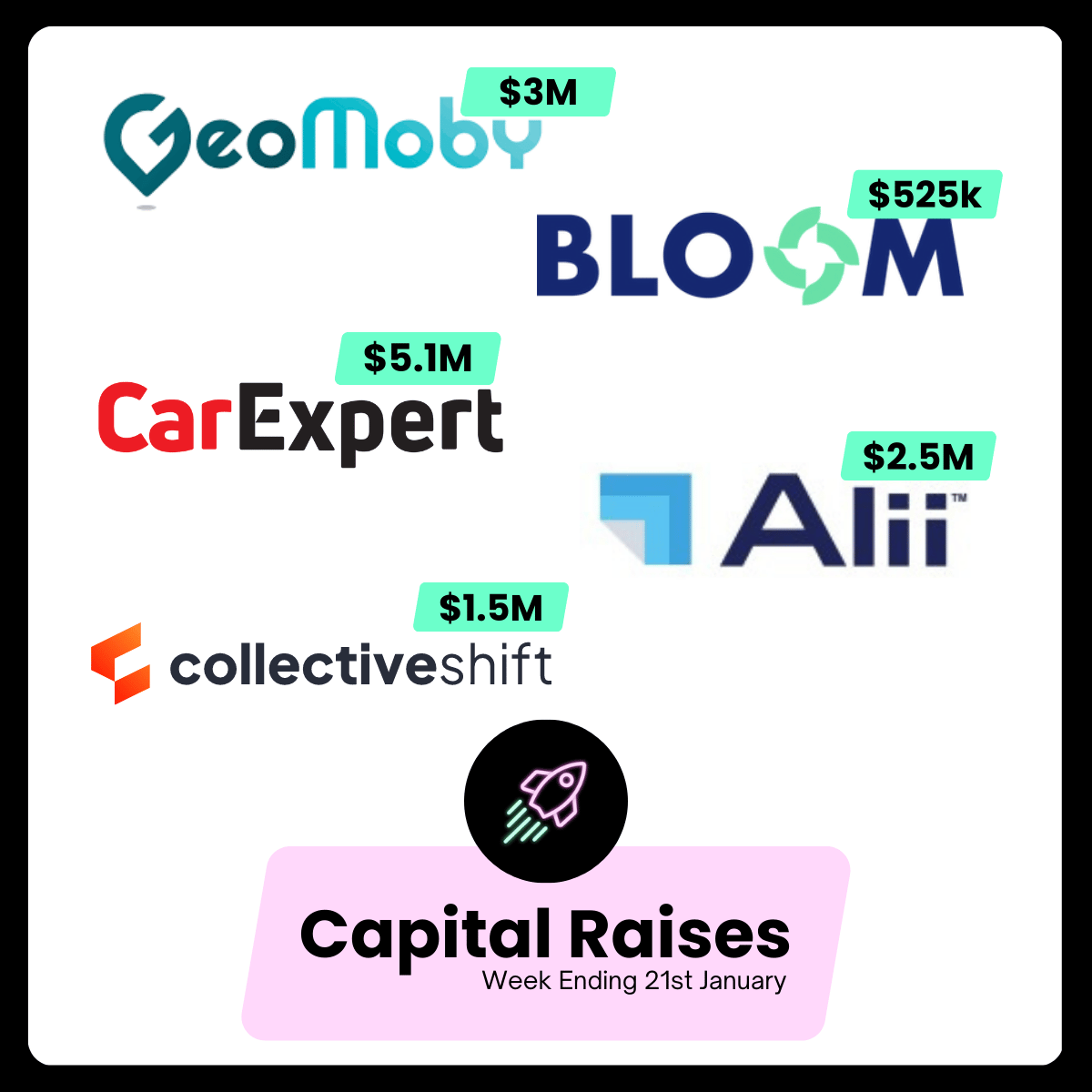

⛏️ GeoMoby lands $3M from European Investors

GeoMoby, an all-in-one live geo platform, has raised $3M. The company has attracted investment from French investors with follow on investment from previous investors. Additionally, GeoMoby has partnered with the Agreement Hub and a grant from METS Ignited. The tech brings visibility to underground mining operations with a focus on real-time communication and safety. The platform allows connections between underground staff and the visualisation of people and assets, with data specific to mining like dwell time, body temperature, traffic, weather, etc. International investors are keen to take GeoMoby beyond Western Australia, as the tech can be applied to above-surface mining operations globally. The new capital will be used to expand human resources in sales and business development and engineering.

Due Diligence: Startup Daily

FinTech / Impact Investing

🪴 Bloom Impact Investing grows with $525K Seed Round

Climate-focused fintech start-up Bloom Impact Investing has raised $525,000 in seed funding. Up co-founder Dominic Pym and Envato founders Collis and Cyan Ta'eed led the round. The smartphone application was launched in 2019 and offers a green solution for investors with commitments as low as $100. Individuals do not attract brokerage fees, while companies or trusts have a minimum of $5K. Bloom Impact Investing is taking a stance against greenwashing by selecting investments that allow all Australians to invest in clean energy. Bloom is riding the tailwinds of growing investor interest in green investments and removes the friction created by brokerage fees and a lack of sustainable investment options. Apparently, a rigorous scientific method is used to ensure investments listed on the platform are worthy. Although funds under management are small at $1.6M, CEO Camille Socquete-Clerc is hoping they'll...bloom! The Seed funds are earmarked to scale the business as well and hire in business development to help grow the Bloom community.

Due Diligence: Smart Company

FinTech / Fraud

🏫 Alii secures $2.5M to keep hackers away from schools' data and financials

Brisbane-based software company Alii has raised $2.5M in a pre-Series A funding round. Maranello Capital led the round following a 300% revenue increase in the last year. The platform offers a fully automated end-to-end accounts payable solution with invoice fraud detection. Additionally, Alii has a centralised web interface for authorised employees to approve procurement requests. Alii has gained a foothold in the Australian school market, which saw several hacks in 2021. The Australian Cyber Security Centre's annual Cyber Threat Report suggests that medium-sized businesses lose an average of $88k for every crime reported, with 79,000 cybercrimes reported in 2021-22. Alii was onboarding 8-10 new schools per month throughout 2022, with many leaving manual processes behind. The capital allows Alli to invest in its team, with customer engagement, sales, marketing and development all likely to grow. The capital comes at a post-money valuation of $10.25M.

Due Diligence: Business News Australia & Australian FinTech

Automotive

🚙 CarExpert drives away with $5.1M

Online car reviews, news and sales website CarExpert.com.au has raised $5.1M in a capital raising round led by Seven West Media. The Perth-based billionaire Laurence Escalante and former Audi Australia executive Nikki Warburton also contributed. The capital comes in at a post-money valuation of $42M, with the business led by a slew of experienced leaders who've had large exits in similar markets. The CEO, Damon Rielly, previously led ASX-listed iCar before it was acquired at $200M, with the founders having exited CarAdvice.com.au for $60M in 2018. By the sounds, they're on a well-driven path. The new capital will help CarExpert expand into Western Australia. The platform gives users greater confidence when researching cars to acquire or sell with reviews and free sold reports. For example, a user who wants to sell their car receives a full report on the value of their vehicle. Once you register to sell your car, an agent will reach out to you to talk you through the true value with recent sale history sourced from the market. A fun feature on the website is the Australian New Car Launch Calendar which highlights when new models are hitting the Aussie market. CarExpert is now earmarking an IPO in 2024.

Due Diligence: Business News Australia

Crypto / Education

📖 Collective Shift recovers and secures $1.5M at $15M valuation

Collective Shift, a crypto content business that explains trends behind digital assets, has raised $1.5M at a $15M valuation. The company has had a spotted past; it was acquired in 2021 after the previous owner allegedly stole $9M of investor money. The new CEO, Ben Simpson, restarted the customer base and grew it to over 1500 subscribers. Recently, the company has announced a partnership with the Australian Open to educate over 6000 new customers. The fresh capital comes from San Francisco-based RNR Capital which focuses on Web3 investments. The business model is simple, charging between $200 and $2000 a year for a subscription to research and analyse crypto projects across the globe. While these subscription prices are on the higher end, subscribers feel more comfortable that this extra diligence may help to avoid highly risky or "rug pull" investments. Collective Shift is cleaning up its reputation and is now an independent voice in analysing the validity of new crypto projects.

Due Diligence: AFR

If you're a founder or investor who has just closed a round, please reach out at [email protected]

Supported By Skale Studio

Design better landing pages. With psychology.

'Conversion 101' is a growth design course for startups. It’s short, to-the-point, and packed with practical strategies. Join the waitlist and get 20% off when it launches.

Notice Board

The GOAT of Aussie start-up ecosystem mentoring programs - Blackbird’s ‘Giants’ - is back for its sixth cohort!

Attend the AMA via Zoom on Tuesday 24th Jan to learn more about the program set to kick off in March.

Best suited to: Early-stage founders looking to validate their start-up idea.

What role will your start-up play in the climate emergency?

Attend this online event hosted by The Founder Institute to hear from experts on the topic from Climate Salad, 1 Million Women, Blackbird & Zero Emission Sydney North.

Best suited to: Founders & operators passionate about tackling climate change.

Want to rub shoulders with some pretty inspiring women in business?

Check out Forbes Australia’s ‘Women’s Summit’, happening in Sydney on the 22nd of March. Fair warning - tickets aren’t cheap, so this might be one to ask the boss to pay for!

Best suited to: Anyone wanting to support & network with Australia’s leading businesswomen.

Have something to put on the Notice Board?

We're always looking for upcoming events & opportunities across the Aussie start-up ecosystem - reach out to [email protected] to add yours!

Accredited Tweeters

Sums up some startup advisors I've met

— #Aaron Tran (#@aaa_ron_)

5:02 AM • Jan 18, 2023

1,000 subscriber cupcake party!!

— #Will Richards (#@MrWillRichards)

9:38 PM • Jan 20, 2023

(KaaS) Knowledge as a Service

A unique job interview hack for aspiring product managers from Earlywork co-founder Dan Brockwell (LinkedIn Post)

Trying to get your head around the Aussie start-up & VC ecosystem or know someone who is? Direct them to ‘The Rising Tide’.

An e-book created by the team behind the Sachin & Adam Show, it’s the perfect guide for anyone looking to ‘break into’ start-ups.

As a bonus, all profits go to charity!

Just in case you haven’t jumped on the ChatGPT bandwagon yet…here’s 20 entertaining uses you might not have come across yet. (Mark Schaefer via Medium)

Thinking about taking your start-up global? You’ll want to get up to speed on your geopolitics news.

Sounds like a drag? Try signing up to International Intrigue. Founded by Aussie ex-diplomats and now run out of the US, it’s the most consumable, entertaining way to get up to speed on global political, tech and business news.

How to return a Venture Fund by Albert Patajo

Albert runs through the power law within the power law and the tension that comes with the law of big numbers. Returning a megafund isn’t easy.

This longform article runs though A16z's recommended strategy on getting to $10M in annual revenue in new or early markets. It's especially focused on sales and marketing strategy.

What is the best thing you read or published this week? Reply to this email to be featured.

Have we missed something? Got some feedback? We love emails, so send one over!

🦤 Find on Twitter

👔 Holler on Linkedin

💌 Email

🚀 Sponsorship Opportunities with Overnight Success

Cya next time,

👋 Will & Gem

If this was forwarded to you, join investors from Startmate, Rampersand VC, x15, Blackbird, AirTree, Superseed, Macquarie, Folklore, Tidal, and Flying Fox in keeping up to date with Aussie Start-ups here!